Why Clean Financial Data Lowers Audit Costs- Real Numbers from AI Cleanup

HelloBooks.AI

· 6 min read

Why Clean Financial Data Lowers Audit Costs- Real Numbers from AI Cleanup

Introduction

Let’s be truthful, the term “audit” isn’t particularly pleasant. For the majority of businesses, it equals paperwork, searching for important information, and the assurance that you are close to losing a receipt for everything you’ve done. What if I told you there was a legitimate, albeit understated, way to lessen the pain and, most importantly, the cost of your annual audit?

That opportunity arises in the area of bookkeeping data cleanup. This service has gone underutilised because it required significantly much manual work until the recent advancements in AI, like those offered by HelloBooks, have enabled this clean data status to be achieved with little manual work.

The Actual Cost of Dirty Data: More Than Just Headaches

Many organisations see bookkeeping and data management as a necessary evil – something that has to be done. However, what most organisations don’t consider is that untidy, inaccurate or incomplete data regarding finance leaks into all areas of its financial health and ultimately results in considerably higher costs of auditing.

Think about it: when auditors get to your place, their efforts primarily involve validation of your financial statements. But if your financial records have unclear differences, multiple missing or incomplete information, or are filled with accidental inaccuracies, they then have to spend a significant number of hours verifying, validating and looking for clarification, and for that, guess who pays for that extra time? You!

Then, you have to think about the advent of AI, the game-changer for audit-readiness AI. The painstaking, manual effort of scrubbing data for audit-readiness is gone forever. These days, tools powered by AI, such as HelloBooks, can rapidly and easily sift through large datasets whilst finding and correcting human mistakes.

A common example would be duplicate invoices removal, for example. While it may seem minor, and you just have a few accidental double entries spread across your data, those duplicates can completely change your total expenses, impact your cash flow model for income forecasts, and, of course, if you are being audited, raise questions about your financial records. Who wants to manually search a records department full of thousands of invoices to find the dreaded duplicate invoices? Having AI work on these issues mean that it can quickly identify and flag duplicated invoices for you, so you can rest easily knowing that you are giving the auditors perfectly tidy expense reports, and totally ensure your financial statements reflect true liabilities

Real Numbers: The Reconciliation ROI on AI Cleanup

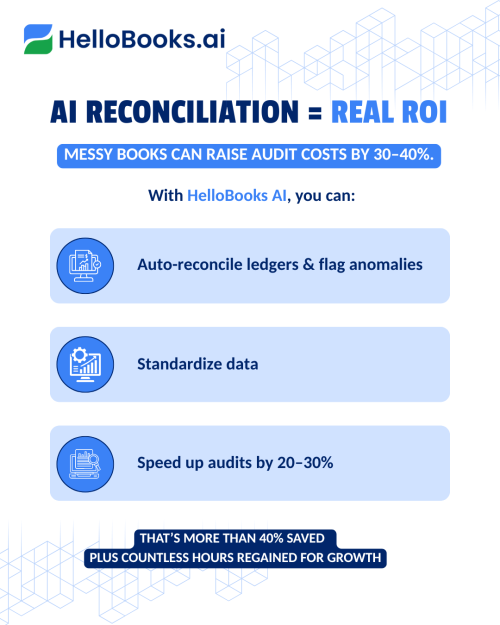

Now let’s discuss some real numbers. What would you expect as savings investing in cleaning bookkeeping data, with the help of AI? The reconciliation ROI can be astonishing.

Let’s say you are a mid-sized business, whose typical cost of an audit is $20,000. If your bookkeeping data has been historically messy, the auditors may have to spend 30-40% more time because of your data mess. That leads to an additional $6,000-8,000 additional cost to the audit firm, just to work through your disarray.

Now let’s consider using an AI-powered data cleanup tool like HelloBooks. These tools can:

- Automate reconciliation between bank statements and your ledger, as well as identify and flag discrepancies and accommodate if an unusual transaction appears while the reconciliation occurs. This will reduce audit time substantially.

- Help ensure consistency with vendor names, account codes, and transaction descriptions throughout your entire bookkeeping system. This allows auditors to gather and interpret your data much more quickly.

- Proactively identify unusual patterns you might determine were fraudulent transactions and clean before the audit. Auditors might just find a couple of anomalies to discuss, which you get the chance to clear before the conversation heats up.

- Dramatically improve the speed of document retrieval for specific transactions, with clean and organised data. Instead of spending several audit hours looking for supporting documents for each transaction, you will easily provide back-up for what auditors need to examine.

- Optimising these processes enables AI to reduce the duration of an audit by 20-30% or more. In our example, that equates to a reduction in audit fees ranging between $4,000 and $6,000. If you also factor in the savings of internal staff time by no longer requiring manual preparation of data and responses to auditor inquiries, then the reconciliation ROI is even stronger. This is not just about saving money. It is also about recovering valuable hours spent on operations that can be reallocated to activities that can drive growth.

Beyond the audit: a platform for growth

Although significantly reducing audit fees is a highly desirable immediate outcome, the advantages of producing clean financial data are far-reaching beyond the audit process.

- Better decision-making. Access to accurate data in real-time allows you to make more informed strategic decisions.

- Improved cash flow management.

- Understanding where your money is at any given time will allow you to make better working capital decisions.

- Increased investor confidence. Clean books create a professional and trustworthy image to potential investors and lenders.

- Decreased risk of fraud. Any anomalies are much easier to spot and remediate.

- Happier employees. Your finance team spends less time on data entry and correcting data and more on analysis and strategy.

Cleaning up and editing your bookkeeping data with the assistance of audit readiness AI (especially a solution like HelloBooks) and focusing on the proactive removal of duplicate invoices isn’t merely a tactic to save you money on your next audit. It is also an essential step in developing a stronger, more efficient, and, ultimately, more profitable business. The reconciliation ROI is not a theoretical concept; it is a real benefit waiting to be realised.

Conclusion

The annual financial audit doesn’t have to be a painful, costly scramble to find paperwork. The secret to significantly reducing both the pain and the cost is in the proactive cleaning of bookkeeping data, which can now be done using AI-powered solutions like HelloBooks. Poor quality financial records directly correlate to lower quality audit work and higher audit fees, as a significant amount of the audit cost is in auditor time spent verifying and correcting the internal chaos.

By automating tasks like bank reconciliations, ensuring data accuracy, and identifying duplicate invoices and anomalies proactively, AI has already significantly improved data cleanup, and consequently, leads to a Reconciliation ROI. AI may lower the audit fees of a mid-sized company 20% or even 30%. These changes are important because the benefits extend well beyond the audit. Clean, real-time data sets the stage for important decision making, cash management, trust and confidence in your investors, and building out a strong finance team.