Vendor and Payable Automation: 6 key features you should know

In today’s fast-paced business landscape, the distinction between prevailing and just managing often boils down to an essential element: efficiency. Back-office functions, such as Accounts Payable (AP) and vendor management have relied on tedious, manual processes often bogged down with paper. But what if you could turn your back-office functions from cost centres to drivers of Real-time vendor visibility and Spend visibility and control? Enter vendor automation, and the magic of HelloBooks.

The Manual Maze: Why Traditional AP Fails

Imagine an office strewn with papers. Invoices could come in via email, or snail mail, or even a fax. An AP clerk had to enter the data in the system, locate the approvers around the organization, and match the invoices to POs and receipts. This manual process leaves room for error and, at times, duplicate payments, which could further lead to overdue fees that strain the relationship between the vendors.

Most notably, the manual process leads to no instant insights. By the time a report is pulled together it is already outdated. You are making financial decisions through a rearview mirror rather than a live dashboard. This is why the magic of accounts payable automation exists,to shine a light and provide a pathway out of the manual maze.

Automated Vendor Management: The Core of Financial Fitness

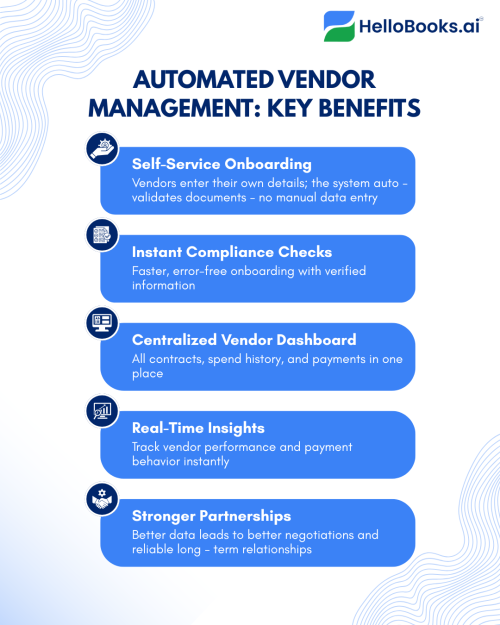

Automated vendor management is not a catchphrase, but rather a radical re-imagining of how your business performs transactions with its supply chain. It starts at the beginning: automated self-service vendor onboarding. With a solution like HelloBooks, new vendors input their own information and documents, which are immediately run through validation and compliance checks. The manual element of the data entry process is completely removed while significantly reducing the time to onboard a new supplier.

Once onboarded, the system now brings all of your vendor engagements and performance metrics to one location. You have total transparency to contract terms, spending history, and payment behaviors, giving you the Real-time vendor insights essential to achieving better negotiation and more sustainable and reliable partnerships.

Say Goodbye to Paper: Invoice Processing Automation

The key aspect of AP automation is the ability to automate invoice processing. This is where organizations see the greatest time and cost savings.

Digital Capture

Invoices are received via digital means or are immediately digitized, taking advantage of advanced Optical Character Recognition (OCR) technology, and the system captures all of the required data (vendor name, line items, and amounts) without a single key stroke from any member of your team. This is the death of the dream of paperless invoicing achieved.

Automated matching and vetting

The system automatically performs a three-way match of invoice, PO, and goods receipt. If everything matches, it can be auto-approved; a process known as “touchless processing.” By implementing touchless processing, your team is only focused on a small percentage of exceptions over the greater volume of invoices.

Smart approval workflows

Approval is routed promptly and automatically with your company’s approval processes and spending limits in mind. No more invoices languishing on someone’s desk for days! This speeds up the whole cycle of the invoice process in considerably less time and enables your company to take advantage of early payment discounts and maintain an excellent rapport with your vendors.

HelloBooks progresses this one step further by providing an integration that is natural and seamless with your ERP or existing accounting software. This simplifies onboarding and gives confidence that the data is consistent and current.

Procure-to-Pay Automation: The Whole Solution

The overall objective is procure-to-pay (P2P) automation. P2P brings all elements of the procurement life cycle together, from requisition to payment, in a single, automated unified workflow.

This end-to-end perspective provides complete Spend visibility and control. You can track a purchase from when an employee originally requests the purchase, through the PO generation, automated invoice processing, and to the final payment. This comprehensive oversight allows the elimination of ‘rogue’ or ‘maverick’ spending and ensures that all spent funds are in compliance with company policy. HelloBooks offers this full view for your P2P process, giving financial leaders greater certainty that they have a thorough handle on company cash flow and spending trends.

Vendor Relationships: The Human Side of Automation

Change the focus from operational efficiency on the inside to the health of external partners.

Become a “Vendor of Choice”: Emphasize taking care to pay vendors accurately and on time builds the company into a “preferred customer.” This means better service, faster deliveries, and more favorable treatment during interruptions in the supply chain. This reliability can be powered by automation.

Re-deploying the Finance Team to Think Strategically: Finally, talk about the value of changing the focus of the Accounts Payable team. When you take away the manual data entry and paper chasing, the Accounts Payable function can become in a more proactive financial strategy role, and the team members can focus more on financial analysis, financial negotiations, and better financial controls.

Cash Flow Mastery: Taking Advantage of Payment Timing

This part discusses the financial implications of speed and control.

Capitalizing on Early Payment Discounts

Emphasize the direct financial advantages of cutting invoice cycle time. Rather than thinking in terms of weeks for invoices to be processed, encouraged processes/behaviors should allow organizations to proactively pursue and earn early payment discounts (e.g., “2/10 net 30”), substantially decreasing the cost of goods and services.

Predictable Financial Planning

Clarify how a P2P system provides a predictable view of impending liabilities. Instead of simply knowing the data of what was spent the month prior, the finance team can begin seeing all open POs and invoices pending in the queue. This supports forecasting cash flows and whether funds can be available to avoid late payment fees, while managing working capital more effectively.

Conclusion

Transitioning from a “Manual Maze” of paper processes to procure-to-pay automated efficiency is no longer a consideration of a modern business survival, but is a requirement. With the adoption of vendor automation and accounts payable automation, organizations are changing the way they execute financial management.

Business solutions such as HelloBooks (and others) have the core benefits of enabling a paperless invoice process, reducing cost and time to process, and enforcing compliance automatically. Most importantly, they provide Real-time vendor insights and Spend visibility and control like never before. Once a finance professional goes from making decisions based on historical reports to real-time with a view of all supply chain institutions, they have taken a big step forward. Now teams in finance can elevate from transactional processors, to strategic partners supporting profitability and building stronger more reliable vendor relationships and, ultimately, long-term success.