The Finance Struggle Is Real — Here’s How Automation Makes It Easy

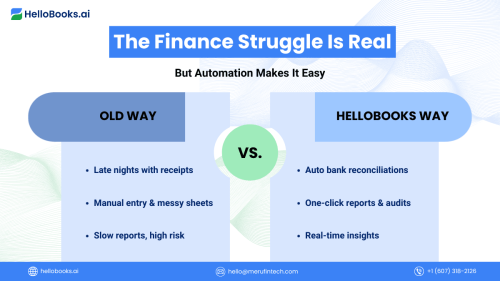

It is also true that not every founder starts their business with the idea of spending late nights arranging receipts or tracking down invoices. The conventional financial management is cumbersome as it is obsolete. The truth? The use of manual data entry, offline spreadsheets and tracking makes a mess, rather than clarity.

That’s where modern solutions come in. Finance Made Easy with Automated Business Tools isn’t just a catchy phrase — it’s a game-changer. Artificial intelligence enables tools that can automate repetitive finance tasks such as bank input reconciliations and categorization, forecasting, and making them proactive drivers of business growth as opposed to reactive tasks that require manual intervention.

With the right system, you can actually have Fun with Bookkeeping. Whenever ideas are shared instantly and reports are instantly auditable with a single click, finance suddenly becomes a strength, not a drain. Founders have an opportunity to recover time, avoid expensive mistakes and increase the financial base.

Finance is boring because there are broken systems. Intelligent automation is a necessity, and yes, it is actually fulfilling.

The Plot Twist: Fun with Bookkeeping Begins When Automation Turns Chaos into Clarity

Finance has always been a headache to startups who slog up to their half-asleep reconciliations on a spreadsheet. However, there is a catch to what I said: through the appropriate automation, such chaos can and does turn into clarity – and even confidence. Finance Made Easy with Automated Business Tools is more than a convenience; it’s a competitive advantage.

Solutions such as HelloBooks.ai with order to the financial chaos need not cost time and skills. Auto-categorization can also be done in real-time that obviates the need to manually tag transactions. Bank feeds are reconciled automatically – no more line by line matching of the entries. With regard to burn rate, invoicing, and cash flow? Available in real time, free of manual entries.

Better still, investor-ready reports run in the background and continue running even when you are asleep to help you have your startup ready all the time to pitch and audit-safe.

This is where something unexpected occurs, you begin to enjoy your financial management. You have visibility, less stress and you make decisions based on real time insights rather than older spreadsheets. Suddenly, it’s Fun with Bookkeeping, because your tools are doing the heavy lifting.

Any automation does not simply clean up your books. It changes your state of thinking. Prone to overrun to overseas. Firefighting to forecast. With changing the motto as finance is boring to finance is working for me.

That is the twist of the plot every founder should get.

Fun with Bookkeeping: How Finance Made Easy with Automated Business Tools Actually Makes It Enjoyable

Bookkeeping does not need to appear like a burden, and when automation comes in the play, then finance grows to be smart, intuitive and, yes, even fun. Here’s how Finance Made Easy with Automated Business Tools leads to Fun with Bookkeeping:

- Real-time dashboards work with raw statistics and paint pictures out of it – see how your business is doing at a glance.AI bookkeeping of the founders will mentally adjust to your behaviour with each use, so it needs less manual involvement.

- Predictive cash flow alerts serve as a financial co-pilot, giving you a chance to know ahead of time about shortfalls that become due.

- Budget targets are made into a game – meet the spending targets and lengthen your runway.

- Automation destabilizes what were repetitive tasks, therefore, leaving you to be strategic, and not about the spreadsheets.

Sensible automation of finance makes finance satisfying as opposed to stressful. You will have control, confidence and oh yes a little dopamine each time your books balance.

Turn Dull into Dynamic: Finance Made Easy with Automated Business Tools at Work

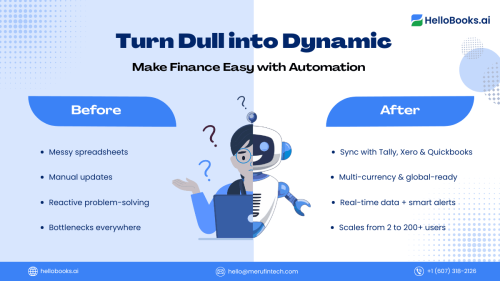

Of course, should controlling finances remain an awkward experience, the issue should not be with the procedure, but with the tools. Finance Made Easy with Automated Business Tools means saying goodbye to static spreadsheets and hello to dynamic, scalable systems that evolve with your startup.

The appropriate scalable finance accounting software does not only automate functions, it alters the way your business operates. It can easily operate at two-man company size to 200+ growing without the pains. CRM, payroll, tax integrations and give a smooth financial environment.

Multi-currency support and in-system compliance controls mean that global growth is not a nightmare. Throw in the bank level security and the role-based access and you have total visibility and protection– without any lack of flexibility.

Activities that were bottlenecks before are all of a sudden put in the background. You are not reacting to problems, but managing the growth. Smart insights are provided through the real-time data. Accuracy is guaranteed using automation.

This is Fun with Bookkeeping, a world where finance empowers your startup, not slows it down. Your back office should not be a burden; with the right tools, it can give you a launch factor.

As Real as It Gets: ZipCart’s Fun with Bookkeeping and Finance Made Easy Glow-Up

Competitor Case: ZipCart (E-commerce SaaS)

At the point when ZipCart reached its seed stage, finance felt like a significant ball and chain and manual spreadsheets, delayed reconciliations, and no visibility: enough said. These were the turning points? Improving HelloBooks.ai.

Within 90 days ZipCart was capable of reducing monthly reconciliation time to only 30 minutes per month, as compared to the 12 hours that it used to take. Their financial head explained the situation best: We have never had so much fun in doing numbers before. That’s Fun with Bookkeeping, powered by automation.

With Finance Made Easy with Automated Business Tools, ZipCart didn’t just save time—they gained strategic advantage. Their dashboards were healthier in terms of clarity, lauded by investors who were able to access real-time information in dashboards. The team would now have the ability to model the demand cash flow and answer questions with data and not estimations.

Early Automation, Lasting Impact: Fun with Bookkeeping Starts Now

The thing is that finance is not boring, it is only outmoded. When you have the necessary tools at hand, what used to be the burden turns into the greatest advantage of your startup. Finance Made Easy with Automated Business Tools means no more scrambling during tax season or second-guessing your burn rate.

Automation will save you time, hone your data, and faster decision-making. You never go through sleepless nights to sort out conflicting data in spreadsheets because your books are always audit-ready, and monitoring of the financial health of your business becomes a daily routine-not a nightmare when financial year-end comes along.

Suddenly, you’re experiencing Fun with Bookkeeping. They need finance software that moves beyond the past and into the future; one that will be more predictive, and one that integrates to work seamlessly throughout their organization.

The secret? Start early. The quicker you automate, the more scaled, investor-impressing and compliant you will be without the chaos.

Do not just make it through in startup money management: learn to work it. When you automate smart, a business will be poised to succeed right on board.