Time Saved: Human vs. AI-Driven Bookkeeping

Introduction

In business, time is one resource that you’ll never get back. For far too long, small to medium-sized enterprises (or SMEs) have seen their most precious hours consumed by bookkeeping. The traditional method of gathering and chasing receipts, manual data entry, and constant reconciliation is not only monotonous – it is costly in terms of wasted time. But imagine being able to take the hours spent wrangling with spreadsheets to instead focus on strategy, customer engagement, and market growth? That is the promise of AI bookkeeping, and this is why the shift to automated accounting systems is changing the way we think about managing business finances. It is not a simple upgrade, it is a fundamental shift in how we save time running your accounting firm.

The Manual Maze: Where Time Goes To Die

Consider traditional bookkeeping for a moment. This process is filled with friction:

- Data Entry: Each and every invoice, receipt, and transaction requires manual input.

Usually multiple times and across multiple systems. It is the most tedious and redundant work. - Categorization: Someone will need to decide if that coffee receipt is a “travel expense” or “client entertainment.” This poor judgment call can hold up the whole closing process.

- Bank Reconciliation: The arduous task of matching entries from bank statements to ledger entries, line by line. In many cases months after the transaction occurred.

- Error Correction: Human error is simply an inevitability with bookkeeping. One typo and the entire ledger is compromised; then it’s hours and hours of sleuthing trying to determine which decimal was in the wrong place.

For a small business owner who is busy with everything else, this maze of manual bookkeeping can become a time sucking endeavor, easily taking 5-10 hours of the owner’s time each week that just is not available. We have a backward looking process, so we may as well use our time wisely! This means that reports are often outdated by the time the process is finished. You are effectively making key financial decisions “blind” as you don’t have currently relevant financial information.

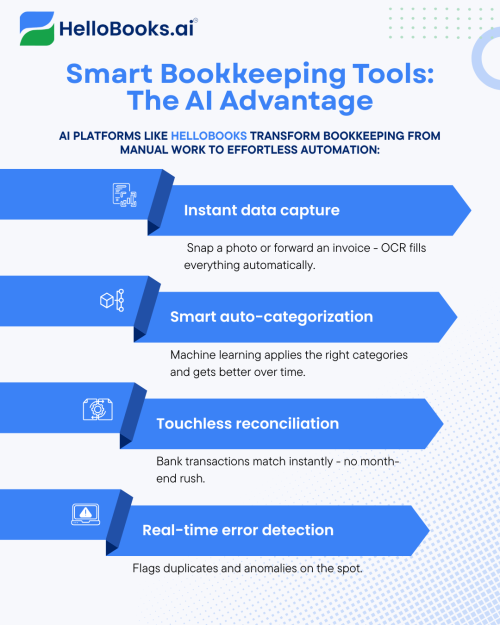

Smart Bookkeeping Tools: The AI Advantage

Here comes AI-fueled financial management. The new generation of tools, for example HelloBooks, doesn’t simply digitize the previous process; it fundamentally re-engineers it with machine learning.

Here is how AI reduces bookkeeping time and enhances accuracy:

1. Capture data in seconds

Now you can wave goodbye to manual data entry altogether. AI bookkeeping is utilising state-of-the-art Optical Character Recognition (OCR) technology. All you need to do to is take a picture of a receipt or forward an email with the invoice and the system will read, extract and automatically fill all of the necessary fields: vendor name, amount of the charge, date, tax etc.

Time savings: Instead of multiple minutes per receipt you can now operate in seconds. The removal of manual data entry will drastically reduce time as well.

2. Auto-categorization and machine learning

The AI doesn’t just enter the data; it intelligently categorizes it. Equipped with machine learning, the automated accounting software learns your business’s spending habits. Did you tag a payment to “Office Supplies” last month? The next month, when that same vendor sends you another invoice, the system will suggest the same tag, or automatically apply it. The more you use the service, the smarter it will become and the less you will have to do.

3. Instantaneous, Touch-less Reconciliation

One of the biggest advantages of AI bookkeeping is instantaneous bank reconciliation, which is continuous and real-time. The setup flows directly through your bank accounts and credit cards. As soon as your bank processes a transaction, the AI immediately and automatically works to match the item to an invoice or receipt in the system. HelloBooks creates that scenario of “touchless processing.”For most transactions, the AI can handle the matching and reconciliation without human involvement, which means there’s no longer a painful end-of-month or end-of-quarter reconciliation process.You always know exactly where you stand with your financial position- up to the moment it cleared your bank.

4. Proactive Error Detection

Because the AI is operating in real-time and cross-references constantly, it is an instant guardian of financial accuracy in your bookkeeping. It can flag anomalies with an instant notification, such as a duplicate payment that could easily be identified as a duplicate, or an entry for a cost that doesn’t match what the AI has learned as the historical category. The beauty here is that the human reviewer can review an exception instead of auditing every entry for price or duplication. The bookkeeper’s role has transformed from a data input clerk to a financial analyst.

The Ultimate Payoff: Focus and Growth

Introducing AI bookkeeping is a significant shift in the way finance teams and owners of businesses spend their time. Now the 5-10 hours spent each week on administration can be devoted to more valuable work.

For Owners of Businesses: You will have more time to focus on revenue generating activities such as sales, marketing, or product development.

For Bookkeepers / Accountants: You will have less time doing data entry and more time presenting strategic opinions, planning, forecasting, or carrying out detailed analysis. They’ll move from being backward-facing recorders to forward-looking partners.

Essentially, smart bookkeeping tools, rather than speeding up the process, fundamentally change bookkeeping into a source of real-time insight. With something like HelloBooks, your finance data is no longer a historical record; it is now a real-time, accurate dashboard for making informed business decisions.

Conclusion

Moving from manual financial processes to AI-based financial management signifies the end of the “Manual Maze” and the dawn of genuine financial agility. Intelligent bookkeeping tools like HelloBooks help you realize a massive return on time spent, since the time-consuming data entry and reconciliation tasks will go.

It is not simply an efficient gain, rather it is a strategic enablement. AI bookkeeping provides nearly flawless bookkeeping accuracy by processing in real-time without touch and detecting errors before they can cascade into a bigger problem. Importantly, it frees business owners and finance professionals from administrative work, allowing them to utilize the hours saved (5 to 10 hours per week for many) on growing their company, forecasting outcomes, and making strategic decisions with impact. It takes them from merely tracking the past to being a real-time, forward-looking financial partner – which puts their business in a position to grow and be more confident and faster moving forward.

Today, the choice is straightforward: stick to the laborious loops of manual data entry and reconciliation, or utilize AI-backed financial management services. With smart bookkeeping apps like HelloBooks, businesses are skipping the phase of managing their books, and getting straight to mastering their finances. The outcome yields significant time-saving in accounting, close to flawless accuracy in bookkeeping and the invaluable capacity to shift human capacity towards high-value, strategic work. The future of finance is frictionless, smart and committed to helping your company speed up your growth.