Mobile-First Billing: What that looks like for On-The-Go Businesses

Simplify invoicing, take payments on the go, and keep cash flowing from anywhere.

A business on the move requires tools that work at the speed you do. Mobile-first billing turns the to-do of invoicing and payments on its head, says Lawless, by turning it from a desktop chore into an on-the-go activity that takes less time, contains fewer errors and improves cash flow. This guide discusses mobile-first billing — a breakdown of what it is, the key components to focus on, how to implement workflows that are practical for field operations and security & best practices to ensure deploying the approach succeeds.

Why mobile-first billing matters

With on-the-go professionals — technicians, consultants, event teams, delivery drivers and independent contractors — often wrapping up work outside an office. “Not being able to go back and invoice from a laptop as I mentioned earlier, causes too much lag time and missed opportunities.” With mobile billing, invoices can automatically be generated and your shipments or deliveries collected at time of service. The payoff is faster payment cycles, more transparent customer communication and less administrative backlog.

Key advantages:

— Faster payments: Customers can pay immediately after a job is done.

— Records truly accurate: Signatures, photos and line-item details right on the job site.

— Better customer experience: Customers love having instant receipts and clear charges that minimize disputes.

—Efficiency: Eliminate double-entry and manual reconciliation.

Core features to prioritize

All mobile solutions are not created equal. Favour tools and design patterns that are grounded in field. Workmanship: Craftsmanship over commodity.

Simple, fast invoicing flow

The process of producing an invoice has to be quick and easy. Pre-formatted templates, favourite service items and available tax rates save you even more time each transaction. Things are also kept efficient with a concise invoice screen featuring totals and optional notes.

Offline capability

Fieldwork tends to occur in low-coverage regions. If an internet connection is unavailable, and transactions are kept in queue for processing when the internet returns to prevent loss of data and maintain billing.

Multiple payment acceptance

People expect options — card or bank transfer, digital payment methods or on-account billing. Automation of immediate approval and traceability increases trust and minimizes follow-ups.

Receipt and documentation capture

Add in proof of work photo taking, approval digital signatures, add attachments to invoices. These components help disputes and generate an auditable trail.

Real-time status and notifications

There are advantages for both business operators and clients when invoices demonstrate such distinct statuses: sent, viewed, paid, overdue. Automatic reminders to keep late payments down with one less hassle.

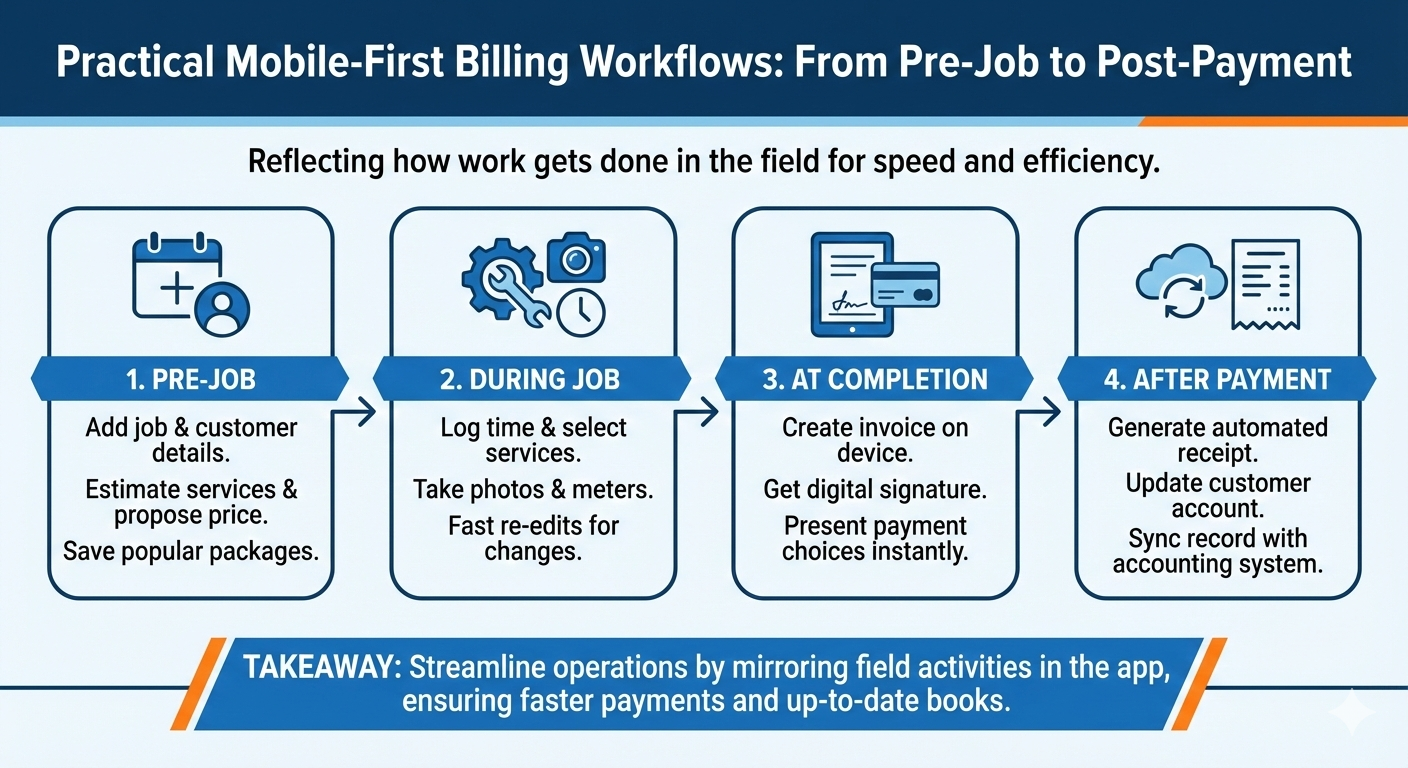

Practical mobile billing workflows

The workflows should reflect how work gets done in the field, not what we do at the office.

Pre-job

Add a job customer details, services estimated session and propose price in the record. Save popular service packages for easy selection.

During job

Log time, select services, take photos or meters from the app. If specifications change, do fast re-edits of the job line items.

At completion

Create invoice from job and show on device. Ask for a receipt and add documentation of the finished signature. Present payment choices right from the invoice page.

After payment

Generate an automated receipt and up-date the customer account. Synchronize the record with your accounting or reporting system to ensure that books are up-to-date.

Optimizing for real-time payments

It’s only a small leap from mobile billing to real-time payments. Payment velocity accelerates, and receivables decrease, when customers can pay at the point of service instantly. To optimize for real-time transactions:

Make it less cumbersome to Change Payment on the invoice screen.

Complete payments immediately with straightforward and structured receipts. Provide contactless and card-on-file options for repeat customers, safeguarding consent and transparency.

Security and compliance considerations

If you’re processing payments, and therefore also storing customer data, on mobile devices, you need to be even more mindful about security.

Device security

Advocate for strong screen locks and biometric verification on billing devices.

Use secure storage mechanisms to protect sensitive information, and ensure that strong cryptography is in place for all transmission.

Data minimization

Gather only what is required for billing and verification of service. Do not save complete card details on a device.

Access controls

Grant role-based access for certain employees to make refunds, view transaction histories including payments info and edit price.

Auditability and compliance

Keep clean logs of the invoices, edits and payments to support accounting and regulatory requirements. Digital signatures combined with time-stamped photos help the traceability.

Best practices for adoption

Mobile billing in a team setting demands considerations for training, processes and key performance indicators.

Start small

Pilot with a sample of users who perform various kinds of work. Collect input on usability and edge cases.

Simplify templates

Standardisation of invoice templates to eliminate confusion. Ensure that the names of line-item are clear and follow conventions.

Train on common scenarios

Instruct on how to process discounts, partial payments, split payments and no-service charges. If that doesn’t yet feel natural, practice playing with customers to test the waters.

Overcomplicating the app experience

Too many fields or choices are going to inhibit the user. Focus on the basics and bury everything else behind an "edit" button.

Ignoring offline needs

A billing system that requires a active connection will earn you an irration but all it takes is one irration to cause exception items. Make it easy to queue and resolve conflicts offline.

Neglecting customer communication

With automatic receipts and clear messaging on invoices, there is less confusion. Create a template to clarify the methods of payment and time frame expected.

Implementation checklist

Select templates and general service items.

Setup payment methods and confirmational message

Configure offline syncing behaviour and conflict resolution.

Define roles for different types of users and permissions.

Educate employees about common claims situations and exceptions.

Track KPIs and iterate the process.

Conclusion

But mobile first-billing may rewrite not only the speed businesses on-the-go operate, but also when they are paid. Create a billing process that is reliable and effective by maintaining simplicity, off line resiliency, secure acceptance of payment, and capture of documentation. With careful implementation and continued tracking, mobile billing will lower administrative costs, accelerate cash cycles and provide staff and customers with a better experience.

Takeaway: prioritize a fast, secure invoicing flow, activate real-time payments and enforce evidence capture to lower disputes and speed up the cash.