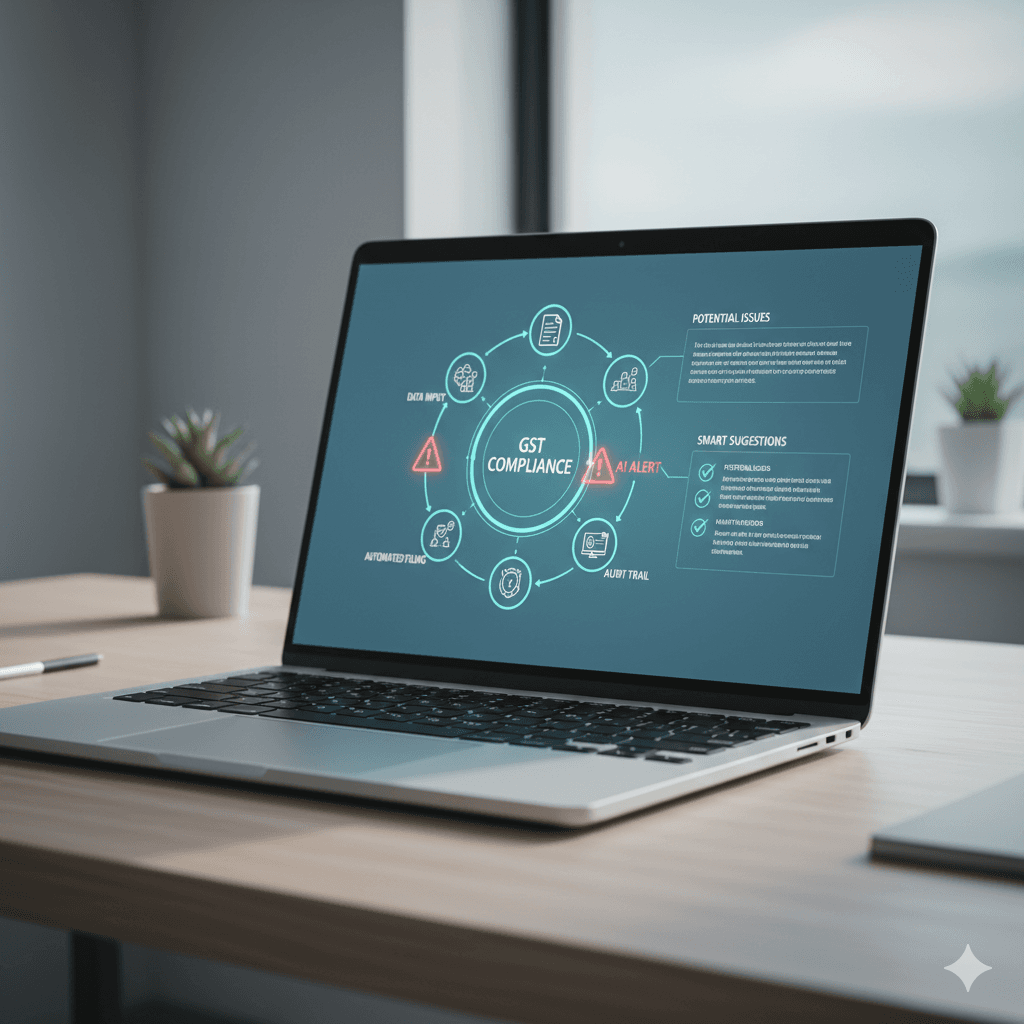

The Role of Automated Accounting in Ensuring GST Compliance through AI

For a large number of businesses, being GST compliant is an operational challenge that never goes away. Constant amendments to the rules, high invoice quantities and narrow reporting periods put finance teams under pressure. AI-driven automation in accounting systems provides a convenient way to eliminate manual efforts, minimize errors and build robust, audit-ready records. This article describes in detail how automation and machine intelligence enable businesses to be more effective and assured in meeting their GST obligations.

Understanding the compliance challenges

Compliance under GST mainly includes proper classification of goods and services, timely generation of output tax and in-time filing of its return, validating vendor invoices & expenses on time, reconciling with vendor/customer data, ITC claim and maintaining evidence for audit trails amongst others. Manual methods are sluggish and error prone: improperly coded transactions, overlooked credits or unmatched invoices can spark notices, interest and penalties. Additionally, disparate lines of business and multiple sources of data can lead to inconsistent data. An automation-led targeted strategy tackles these pain points at their root.

Ways in which AI enhances invoice and data capture

Accurate data capture is one of the first steps to ensure better GST compliance. Document Recognition: AI can automatically capture fields from invoices/receipts such as invoice number, date, supplier GSTIN, HSN code/SAC- tax-related fields etc., per their requirement. OCR, in combination with NLP minimizes the risk of typographical or transposition errors.

And automation not limited to direct extraction, ML models are capable of learning from past corrections and get better over time. For instance, if a finance user corrects an HSN code or tax rate then the system utilizes this feedback to learn from and make better classifications in future. Such a perpetual learning loop cuts redundant verification work and imparts additional uniformity in transactions volumes.

Automated classification and tax-rule application

AI automation aids the consistent application of complex tax rules. The rules engines can be used to map item descriptions with the correct HSN/SAC codes and tax rates. When there are exceptions—like for a composite supply or mixed supply—the system can identify transactions to go in for human review against configurable thresholds. This mix of Automated with targeted human oversight can let you work most of the transactions automatically even if it means to sacrifice some of control on edge cases.

Rules can also be time-sensitive. If hit with a tax rate increase on a certain date, the automation was able to apply the correct rate based on the invoice date so no more mistakes when rates changed. This minimises the number of post-filing amendments to correct errors in past returns.

Reconciliation and matching at scale

One of the key compliance exercises would be reconciling the supplier invoices with purchases as recorded and GSTR-style returns. It is not feasible to manually match hundreds or thousands of entries. Automated reconciliation matches supplier submitted invoices with internal purchase records and filed returns, by using deterministic rules and fuzzy-matching algorithms.

In case of discrepancies—where the amounts do not match or if GSTINs are not available—the exception is also classified based on severity and probable reason thereof by the system. Finance teams can expect to spend more time focusing on high-risk discrepancies for review rather than simply running matches. This targeted approach shortens close cycles and enhances the timing of claimed ITC.

Input Tax Credit verification

It says that a proper input tax credit can be claimed only if supplier invoices are not fake, GSTINs have been generated and the nature of supply also allows credit. Automation can verify supplier registrations against reputable sources of truth and cross-reference deactivated accounts, pattern anomalies and other red flags. It can also keep a living record of suppliers’ status for ITC eligibility.

AI can also help by cross-referencing purchase invoices to accounting entries and identifying duplicate claims or credits that were only to a certain point. The system provides contextual explanations and recommended actions when potential risks are identified—empowering the finance team to act on issues with drastically less manual digging.

Return preparation and error reduction

The process of preparing GST returns includes summing together transaction data into prescribed formats and reconciling summary totals to account balances. The addition of automation allows return fields to be pre-populated with validated transaction data, perform reconciliation checks and identify any mismatches prior to submission. This pre-filing validation minimizes the probability of returns being filed incorrectly and resulting in subsequent corrections.

The system identifies all pre-checks in the relevant invoices are recalculated internally by the application (e.g. grand totals, tax rates etc), that correct values are included for field according to distance period classification) and price rounding rules. By identifying problems early in the process, agencies minimize the need for post-filing amendments and the administrative burden that comes with correcting issues after a rule is already on the books.

Audit readiness and record keeping

And one of the most common things regulators ask for are documents and a clear audit trail. Automated systems create and maintain an immutable transaction log that includes the raw capture documents, the data extracted from the documents, a change history and user attestation. Time-stamped audit trails and version history records make it easy to show how a value was calculated and who authorized it.

Records are retrieved more quickly thanks to automation, plus retention policies are made easy with records organized and indexed. This ultimately minimizes the time spent attending to audit inquiries and reduces the chances of penalties resulting from lack of or inaccurate documentation.

Proactive alerts, deadlines, and workflows

And beyond processing transactions, automation aids teams in keeping track of timelines for compliance. Users can create alerts and workflow tasks to keep responsible individuals informed about filing dates, chasing vendors or pending exceptions. Escalation protocols are in place, which push emergencies up to upper-tier staff in the run-up to a deadline.

Automation allows us to bake in compliance into our day-to-day, and not rely entirely on tribal knowledge, and rows of sheets. Teams are more predictable and resilient, resulting in less last-minute scrambling before filing deadlines.

Security, privacy, and governance considerations

GST data is sensitive and needs stringent governance. Automated solutions should include role-based access controls, encryption both at-rest and in-transit, as well as transparent data retention and deletion policies. Access logs and consent workflows also offer further governance protection.

The automation process should also cover change management and staff training. Finance teams also require clear direction on what to do with exceptions and overrides, and how to understand the system’s recommendations. When machines and people can work together, compliance as well as operational efficiency is enhanced.

Measuring ROI and continuous improvement

The positive effect of automation can be calculated in fewer manual hours and reduced filing errors, less amendments, and decreases in the time consuming reconciliation cycles. Norming metrics before automation allows you to measure your progress. Tracking exceptions and listening to user feedback allow you to continuously iterate on model tuning and process improvement.

Conclusion

Automation on AI enabled accounting deals with several practical aspects of GST compliance. From accurate data capture and smart classification through to massive reconciliations, ITC validation and audit readiness, automation drives the labor out of the manual work performed while strengthening compliance posture. By optimizing machine efficiency while maintaining targeted human oversight, organizations can file with confidence, mitigate risk and release finance teams to provide analysis and spend time on strategic activities versus monotonous compliance tasks.