transaction-categorization" class="text-4xl font-bold my-6 scroll-mt-24">Artificial Intelligence is Required to Get Smarter in Transaction Categorization

The classification of the financial transactions is one of the most tedious activities and prone to error in keeping books. As volumes of transactions continue to increase, reporting inaccuracies, failure to claim tax reliefs, or breach of compliance may start occurring due to minute errors. This manual process is time and attention-sucking to the finance departments and the start-up founders. Enter the AI-powered transaction categorization, a scalable, viable one, which is the real-time categorization of financial data by means of machine learning and pattern recognition. Automation of the way organizations process AI sorting transactions enables companies to track the expenses, correct their taxes, and have cleaner books, which are ready to be audited. Separating SaaS subscriptions and ad spend, matching payments to invoices, or any other process, AI not only catalyzes it but also makes it better. Smart transaction categorization ceased to be an option in terms of modern finance work; it is the first way of achieving scalable and reliable bookkeeping.

transaction-categorization" class="text-3xl font-bold my-5 scroll-mt-24">What is AI-based on Transaction Categorization?

Transaction categorization is a way to categorize transactions such as purchases, subscriptions, or income into the related accounting categories (e.g., software expenditures, revenues, payroll). It forms a mandatory pillar of proper bookkeeping, helping to manage the financial reports, expenses, taxes, and comply with audits.

The traditional approaches are very manual-intensive and rules-based or fixed templates, and tend to either cause inconsistent or late categorization. That’s where AI sorting transactions changes the game. Building patterns AI uses the historical data, merchant context, transaction description, and user behavior. With time, it will automatically classify new transactions with high accuracy with incredible precision.

This intelligent automation is exploited by modern accounting platforms, such as Hellobooks.ai, resulting in the minimization of human error and removing the necessity of repetitive data entry. Upon the connection to a business bank feed or payment gateway, the system works in real time to analyze incoming transactions and then suggest the appropriate category and flag any anomaly.

Effective bookkeeping and reduced finance burden AI transaction categorization not only benefits the bookkeeping precision but additionally liberates money groups to center on an increasingly important arrangement determination and forecasting. Among businesses with fast growth, it provides the efficiency and accuracy businesses must have to remain financially flexible and investor-ready.

How AI Sorts Transactions Better than Manual Operations?

It might sound like a viable idea to create a financial transactions category process manually, especially at the beginning when a business is small, but as the number of financial transactions increases, it becomes a bottleneck. Here’s how AI sorting transactions outperforms traditional bookkeeping:

Manual Methods:

- Take a great amount of time, concentration, and financial know-how.

- Subject to human error, the reports may be distorted by misclassifications or set audit flags.

- Not able to scale effectively, hundreds of transactions end up slowing the finance team.

- Rely on subjective judgments that are not consistent over time or among individuals within a team.

AI-Powered Categorization:

- Applies machine learning to predict what has been happening historically and gets more accurate as time goes by.

- Can process thousands of transactions within seconds in the reality of smart bookkeeping.

- Understands repeating vendors and behaviours to auto-categorise new transactions (e.g., classify a transaction as revenue when it contains words like “Stripe payment” or “Google Ads” as advertising).

- Adjusts to your Business logic and individual chart of accounts.

- Does away with the manual input of data to ensure that the finance departments can focus on the forecasts, plans, and strategies to increase.

Real-World Examples:

- PayPal client payment is marked immediately as income.

- Amazon sales is marked as one of the selling source.

- Advertising and marketing are one of the recurring bills of LinkedIn.

AI-powered categorization delivers unmatched speed, consistency, and adaptability, enabling SaaS founders and finance teams to operate with clarity and control from day one.

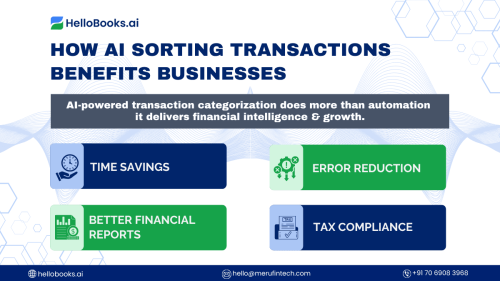

How AI Sorting Transactions Benefits Businesses

Automation is only one piece of what AI-powered transaction categorization has to offer; financial intelligence and expansion are other fundamental aspects. This is how it helps contemporary businesses:

a. Time Savings

- It eliminates manually entered data or simply checks the individual transactions.

- AI sorts out transactions immediately they are in your payment platform or into the bank feed.

- Business owners recapture precious hours per week, time that is best used in strategy, products, or customer development.

- Sample: A founder of a Saas that applies AI to run intelligent bookkeeping said he saves 6-8 hours a week that he had to spend categorising expenses in the past.

b. Error Reduction

- Human classification is inaccurate and has issues of accuracy when facing a deadline.

- AI provides classification with an approximation of perfection because it is based on pattern recognition and the history of its behavior.

- Minimizes the expensive mistakes of misclassification, which affect an audit’s preparedness or investor confidence.

c. Better financial report

- Regular data classification will make data cleaner and the generation of reports quicker.

- Up-to-date, often-used reports are Profit & Loss (P&L), cash flow, and burn rate.

- Actionable insights become available to finance teams and founders as soon as they become ready, rather than at the month-end close.

d. Tax Compliance

- Automatically categorises transactions in the appropriate category of tax deduction.

- Assists in being audit-ready and does away with skipped deductions.

- Permanent and special-purpose expenses are tracked correctly to facilitate end-of-year reporting.

The stressful concept of financial operations turns into a strategic asset with AI-enabled smart bookkeeping: it provides founders with clarity, compliance, and control since day one.

How AI Learning is Better in Categorizing with Time

One of the most powerful aspects of AI sorting transactions is its ability to learn and improve through machine learning. The system starts off categorizing based only on the context, but becomes more and more intelligent, becoming smarter and more correct as more transactions are processed.

As a simple example, let us say that a company periodically purchases such tools as Slack or Notion, then AI will be able to recognize such spending and assign it to the categories of subscriptions or periodic spending without any human interaction. This learning is derived through data on a historical basis and identification of regular descriptions of transactions, vendors, and frequencies.

If this is not smart enough, then the feedback loop makes the bookkeeping even smarter. People will be able to check and change prospective categories once present, such as swapping a transaction labeled as marketing to consulting, and the AI will learn it. The corrections perfect the model, allowing it to be closer to the actual needs of that business in the categorizations to be done in the future.

You end up with an adaptive system that changes in line with the financial behavior of your company, eliminating levels of manual control and creating more and more accuracy with every single transaction it deals with.

Real World Example of AI: Applications

AI sorting transactions is no longer a futuristic concept; it’s already embedded in the daily operations of modern businesses. Small business owners who rely on accounting software systems such as QuickBooks and Xero have enjoyed automatic categorization of transactions, where their expenses are recognized and classified on the fly. When it comes to recognizing such things as office supplies, software subscriptions, or customer payments, there is no longer a human involvement required, with AI.

Freelancers and consultants apply AI-based tools to automatically label deductible expenses, which makes their tax filing much more comfortable. E-tailers use AI to put hundreds of transactions, including those made by the suppliers and those needing to be refunded, into categories without human intervention.

In professional services, AI can assist companies in organizing those who can bill clients, travel costs, and monthly software costs in the right way. In retail, it separates inventory orders, POS revenues, and overhead costs regarding operations.

Regardless of industry, AI sorting transactions ensures financial clarity and eliminates guesswork. Automating one of the former manual processes, enterprises of every size accomplish balanced books, enjoy the stress-free tax season, and acquire insights more quickly than ever, proving that smart technology has become an inseparable component of smart bookkeeping.

By Stepping into AI-based Transaction Categorization

Adopting AI sorting transactions into your financial workflow is easier than ever. To get started, select a trustworthy accounting system that has AI-driven categorization as a feature, and the most popular products can be QuickBooks Online, Xero, and Zoho Books. Such platforms facilitate smart bookkeeping because they automate everyday money management.

After you pick a tool, you will need to connect business bank accounts, credit cards, and payment gateways such as Stripe or PayPal. The artificial intelligence will start processing transaction patterns instantly.

At the initial phase, examine and change the proposed categories. As an example, relabel a charge listed as “Other” to “Advertising” so that AI gets used to your preferences. The system can be made more intelligent and business-aligned with only a couple of corrections.

Once the AI is set up, it will do continuous sorts behind the scenes, leaving you to decide. All your books will be consistent and correct without wasting your time. It is the basis of really automated and intelligent bookkeeping.

It is Time to Automate Your Transaction Categorization

The overall task of financial data handling should not be painstaking, strenuous, and often erroneous. A transaction categorization with the help of artificial intelligence ensures business owners can stop sorting transactions manually, minimize expensive errors, and create reports quickly and precisely. Such smart systems not only automate your bookkeeping but also learn about your business-specific spending patterns as time goes by.

When smart bookkeeping tools are adopted, repetitive actions are reduced, and efforts devoted to increasing, planning, and customer service will also be increased. As a startup founder or even a small business owner, early automation of your financial operations makes it easy to scale.

Are you still categorizing your transactions manually? Then you have to switch to AI bookkeeping. Save time and decrease error level now! Work on the platform that works best for you and allow AI to revolutionize your back office, one transaction at a time.

.png&w=3840&q=75)