How AI Bookkeeping Will Replace Data Entry Forever

HelloBooks.AI

· 6 min read

Introduction

In the business world, there are not many tasks that are as loathed, yet as critical, as data entry. It is the monotonous, mind-numbing work of moving numbers from a receipt, an invoice, or a bank statement onto the accounting ledger. For decades, data entry has been the bottleneck for financial management and a drain on time, resources, and brain power. It is also the leading cause of human error in accounting.

However, the age of the beleaguered bookkeeper squinting at a crumpled receipt is over. We’re in the midst of a generational shift, powered by Artificial Intelligence (AI) that can offer a completely new reality: AI data entry elimination. Not just the next iterationa whole transition to automated bookkeeping, to a new paradigm of hands-off accounting, and at last, to error-less finance.

The Tyranny of the Typo: Why Manual Entry Was Always Going to Die

Prior to AI, the workflow was unbelievably linear. A transaction took place, a paper or electronic document was created and someone (a human) had to manually enter that data into the accounting software. Every keystroke was a chance for a typo, miscategorised entry, or a duplicate entry.

These minor errors are not simply small irritants; they compound. One misplaced decimal threw the entire reconciliation messed up for a month and required hours of searching as quickly as possible, problematic misstatements in financial statements, and possible expensive compliance issues. The irony is that the most important part of keeping a trustworthy set of books – the raw data entry – was historically the most vulnerable to human error.

AI’s role in bookkeeping is to not just reduce risk; it eliminates the human factor entirely and thus provides truly error-free finance. By taking away the tedious, repetitive work, it allows human expertise to be used on strategic analysis – the very reason you issue a finance function in the first place.

Automated Bookkeeping: The AI Mechanism

The essence of this disruption is the intelligence that exists in AI technologies like Optical Character Recognition (OCR), Machine Learning (ML), and Natural-Language Processing. Together, they form a very strong engine for automated bookkeeping.

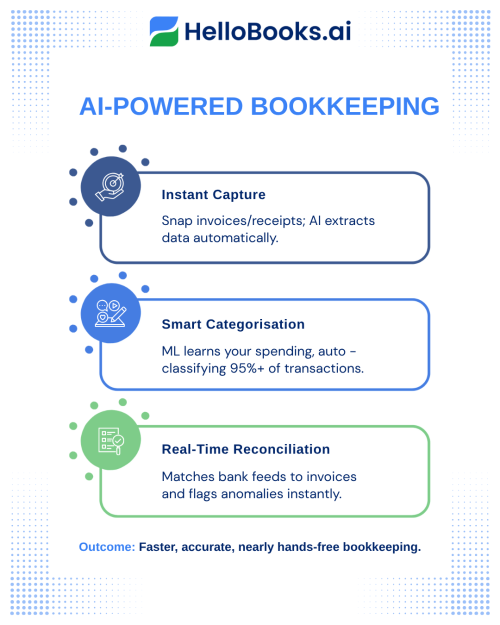

1. Instant Document Capture and OCR

The old method of a shoebox of invoices is a thing of the past! In the present day, with the availability of numerous mobile accounting applications such as HelloProcure, an employee could perhaps take a photograph of a receipt or invoice. The app uses Artificial Intelligence (AI) and machine learning to utilize Optical Character Recognition (OCR) technology to read the receipt and extract basic information: the name of the vendor; the date of the invoice; the total of the invoice; and tax. It only takes a few milliseconds, and the capture has occurred, converting the information from an image to a structured, machine-readable data-file. With these features for the ability to input information from source documents, instant input potentially makes it possible to eliminate 100% of manually entered data.

2. Intelligent Categorisation with Machine Learning

Once the data has been extracted, it is time for the last traditional task of sorting and classifying the information in the new file. Here is where Machine Learning comes into play. Now, when a transaction comes through bank or credit card feed, the AI will compare categorised entries of the same transaction type made for the thousands of transactions it processed previously.

For example, it does not follow the rule set, but the AI “learned.” After manually categorising the first few Starbucks transactions as eating out, the ML model learns and will classify the next entry as eating out with confidence. Eventually, the model learns your own unique spending habits to categorise the transaction for you. Over time the model categorises transactions for you 100% of the time, providing over 95% automatic bookkeeping function.

3. Intelligent Reconciliation and Detection of Anomalies

AI interfaces directly with bank accounts and payment processors to automatically pull real-time data. The system continuously cross references those bank feeds with the expenses and invoices captured through OCR. Tools like HelloProcure instantly reconciles an incoming payment to the proper invoice or a bank withdrawal to the appropriate receipt in an instant.

Importantly, AI will never get tired or distracted. It is always on constant lookout for anomalies it will flag that an invoice has been submitted twice or that there was an unusually high transaction exclusively related to expenses. This real-time vigilance keeps you in the state of exceptional financial accuracy and helps ensure that small mistakes do not blossom into much larger financial problems.

The Beginning of Hands-Off Bookkeeping

The transition to automated bookkeeping is more than a technology change; it is a philosophy change. It takes accountants from their previous transactional role of data entry and reconciliations, to a strategic role of data analysis and advising.

To the business owner, the outcome is significant:

- Real-Time Financial Position: Because data is entered into the system automatically, as soon as it is generated, your financial dashboards are always up to date. You no longer need to wait until the month end to get an accurate view of cash flow.

- Time Saved: The time now freed from erasing AI data entry can be spent on high-value activities: planning for growth, interacting with customers, or developing products. That’s hands-free accounting.

- Audit Ready, Each Time: Because every transaction, receipt, and bank feed can be recorded, categorized, and reconciled by an automated bookkeeping system like HelloProcure, your books will always be clean. Tax season is nothing more than the act of exporting reports, not digging through piles of paperwork.

The financial function of a business has changed from simply a history archive, recording what has happened, into a living, breathing, predictive tool for the future. AI-driven systems are now capable of identifying trends and generating predictive cash flow forecasts with remarkable accuracy, guaranteeing that zero error within finance is directly aligned with the decisions made proactively regarding the business.

In the digital economy, speed and accuracy are the nonnegotiable competitive edge. The complete elimination of manual data entry by AI is not only inevitable, it’s essential to success for every business moving forward into the 21st century.

Conclusion

The removal of manual data entry by Artificial Intelligence signals the definitive end of accounting’s “Tyranny of the Typo”, a period often tedious and fraught with error. The transition initiated by technologies like OCR and Machine Learning use in systems like HelloProcure are more than leaps and bounds in convenience, they represent a strategic shift away from the transactional ledger to finance as strategic management. AI is now able to instantaneously capture, intelligently classify, and perpetually reconcile every transaction, resulting in a level of finance devoid of error and real-time accuracy unavailable until this point.

For the business owner, this translates to hands-free, liberated accounting and many hours saved that can be repurposed to growth activities like product creation and customer recruitment. The finance function changes from a historical record to a living, predictive tool able to provide instant visibility to cash flow and an always audit-ready set of records. The ability to operate in the digital age means speed and flawless accuracy is the only competitive advantage. When you embrace the elimination of data entry by AI, you not only have clean records, but a foundational, strategic basis for understanding what the future might bring and mechanism to grow.