AI-Driven Hospitality Accounting and Operations

Introduction

The hospitality business ultimately is dependent on quick decision-making, sound financial reporting and operational finesse. The AI-powered future of hotel accounting and operations uses machine learning, automation and advanced analytics to transform the way properties drive revenue, expense outlay and guest satisfaction. This article examines specific ways in which AI can be used to improve accounting and operations, describes the short-term advantages and provides some practical tips on rolling out implementations over time.

What we’ve learned from AI and why it is important for the hospitality accounting industry

Hospitality accounting demands recurring transactional work in complex revenue recognition environment, seasonal demand swings and the need of timely and accurate forecasting. Isn’t there a better way of doing that than manual work? AI eliminates mundane duties including invoice paying, reconciliation of ledgers and variance analysis by automating pattern recognition and anomaly detection. From the moment accounting teams are released from day-to-day work, they begin to concentrate on strategic analysis and compliance, which results in an increase in both accuracy and insight.

AI capabilities that affect Finance and Operations

- Automating transactional activities: AI-powered document recognition and workflow automation speed up accounts payable and receivable, eliminate late payments, and slash human error. Policies can be automated to apply across your portfolio.

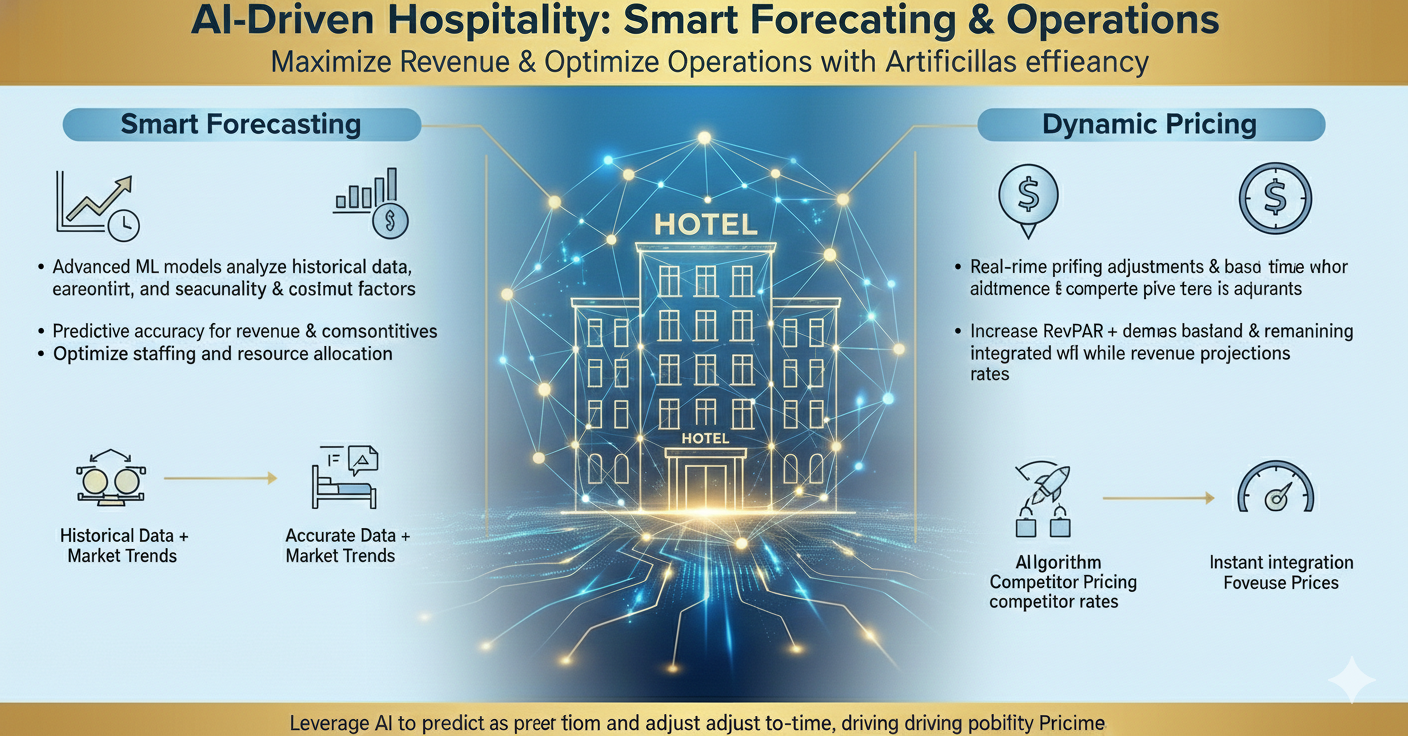

- Smart forecasting: Advanced machine learning models consider historical occupancy, booking lead times, seasonality and external factors such as events or weather to generate even more accurate short-term and long-term forecasts of revenue & cash flow.

- Dynamic pricing: AI models examine demand signals and competitor prices to recommend the best price adjustments in real time. This increases the revenue per available room but in a way that stays competitive and still satisfies the guests.

- Anomaly detection and compliance: Algorithms can identify odd transactions, potential fraud or regulatory violations much quicker than manual reviews, helping internal controls and audit preparation.

- Operational efficiency: AI-operated labour and inventory prediction, along with maintenance scheduling, enable companies to reduce waste and staff according to demand, in turn reducing operational costs while enhancing service levels.

Practical Use Cases

Automated Revenue Recognition and Reconciliation

AI can link its reservation and billing systems to accounting ledgers, further streamlining revenue recognition by automatically applying rules or flagging exceptions. Booking channel reconciliations to accounting merge more quickly with quicker month end closes and a more reliable set of financials.

Better Projecting of Cash Flow and Staffing

To get even more sophisticated apply your occupancy forecasts against payment patterns and finance teams can model how cash flow plays out across demand scenarios. Using these forecasts, hospitality operators can staff and schedule to the demand that fits their go-forward revenue expectations, saving on labor costs without sacrificing guest experience.

Dynamic Pricing and Revenue Management

AI-based revenue management systems track booking curves and cancellations, along with reviewing competitor pricing, to make price recommendation adjustments. Combined to accounting, these pricing decisions are instantly taken into account in real-time revenue projections for better planning and immediate perormance tracking.

Expense Control and Procurement Optimization

Through machine learning, it’s possible to examine vendor invoices and historical spend to recommend purchasing bundles, better terms or to consider other suppliers. Predictive inventory management reduces carrying costs and eliminates stockouts that could affect guest services.

Audit Trail and Risk Management

AI systems maintain rich, searchable log files of decisions made and exceptions taken, thus providing auditors a greater level of transparency. Anomaly detection helps in minimizing revenue leakage and fraud by identifying unexpected patterns well in time.

Implementation Roadmap

- Prepare with a pre-assessment: The first step is an accounting and operational workflow mapping exercise that can help identify lots of candidate tasks within high-volume, repetitive processes, as well as key data sources. Focus on those with the greatest business impact since errors or delays have the biggest business impact.

- Incremental pilot automation: Pick a single process — such as invoice processing, nightly revenue reconciliation or demand forecasting — to pilot. Calculate time saved, error elimination and business impact before scaling up.

- Integrate data sources judiciously: Trustworthy AI relies on clean, consistent data. Implement data governance, normalize naming conventions and automate property management-POS to finance datasets.

- Cross-functional teams: We need to bring together accounting, revenue, operations and IT views in order to make sure AI solutions work within real-world constraints and are likely to be adopted by users.

“There probably isn’t ever a moment when we stop thinking about what it is the model is identifying,” he adds. Monitor and iterate: Treat models like living documents. Constantly monitor forecast accuracy and pricing recommendations, re-train the models with new data, adjust business rules to adapt as market conditions evolve.

Change Management and Skills

The transition to using AI must be managed with care. Training staff in data literacy and analytics enables accounting teams to understand the outputs of AI and how to act upon them. Real-time visibility into the automated rules and escalation paths should be kept transparent to ensure control and confidence. Begin small to gain confidence and show measurable ROI before rolling out.

Risk and Ethical Considerations

AI models can perpetuate biases in the historical data, and automated pricing should consider fairness as well as brand reputation. Have clear pricing rules, some form of guest segmentation (based on the types of guests one would receive) and automated accounting decision. Keep human in the loop for last mile high risk or sensitive activities.

Measuring Success

KPIs are shorter month-end close times and a reduction in days sales outstanding, more accurate forecasts, higher revenue per available room and lower operating costs. Monitor these measures on a regular basis to assess the business value of AI implementations and determine which ones to invest in next.

Conclusion

AI technologies for hotel accounting and operations can represent a significant route to improved efficiency, better forecasting and more intelligent revenue management. By automating the repetitive, improving forecasting and bringing dynamic pricing into play, properties are able to shift their finance and operations teams to focus on growth. Execute carefully – ramp up with focused pilots, make sure your data is clean and organization has capabilities built to support it – for a change that boosts revenue and operational performance over time.